Australia's Current Housing Supply Crunch

According to the Urban Development Institute of Australia (UDIA), Australia is short by over 175,000 dwellings, with projections indicating this gap could widen to over 300,000 by 2028 if supply trends do not drastically improve.

- ABS Building Approvals (2024) fell 6.7% year-on-year, driven largely by a decline in detached house approvals.

Greenfield land releases slowed dramatically in Sydney and Melbourne.

CoreLogic data (April 2025) shows steep price increases in under-supplied regions such as Brisbane, Adelaide, and Perth.

Population Growth & Migration Fuelling Demand

Australia’s population exceeded 27 million in early 2025, growing at its fastest rate in over a decade (2.5% annually).

Net overseas migration reached over 525,000 arrivals in 2024—a record high.

Strong interstate migration is driving demand in Queensland and Western Australia.

Cities like Brisbane, Perth, Adelaide, and regional hubs like Geelong, Ballarat, and the Sunshine Coast are under pressure, with new infrastructure and job growth only intensifying the need for housing.

Rental Demand at Crisis Levels

National vacancy rates remain below 1.1%, with Perth and Brisbane under 0.7%.

Sydney’s median weekly rents for houses surged over 13% YoY.

Regional Queensland unit rents rose nearly 18%.

This is not just a rental boom—it’s a systemic under supply issue made worse by the exit of investors in the 2020-2022 period.

Affordability Is Reaching Historic Lows

Sydney’s dwelling value to income ratio now sits at 9.5—among the highest globally.

Mortgage serviceability now consumes over 45% of household income.

Even with a recent 0.25% rate cut, affordability remains a major hurdle in capital cities.

Property Snapshot:

A Timely Opportunity in Today’s Market

In response to rising property prices and fierce rental demand, savvy investors are turning to medium-density dwellings such as townhouses—especially in high-growth zones.

We’ve identified a high-growth opportunity:

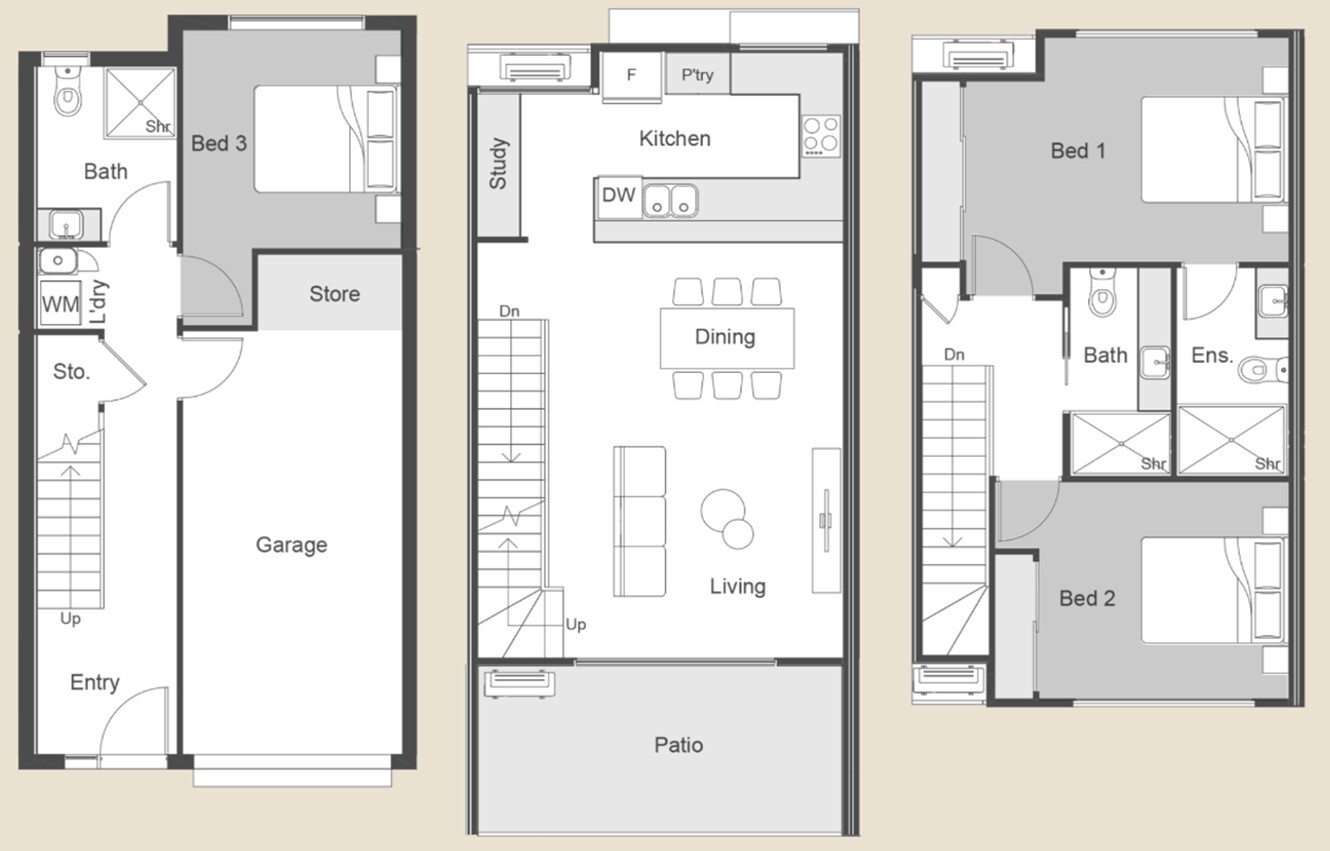

Type: 3-bed, 3-bath, 1-car townhouse

Price: $825,000 (only 2 available)

- Size: 156.2 m²

Rental Income: $680 per week

Vacancy Rate in the Area: Just 0.7%

Completion: Q1 2026

Contract Type: Single contract—suitable for SMSF purchases

Why This Matters

With affordability concerns and rental shortages shaping Australia’s housing outlook, these townhouses offer an affordable entry point with solid yields and low vacancy risk. Their design caters to the modern urban lifestyle while appealing to a growing renter demographic of professionals, downsizers, and single-person households.

Final Thought

TALK TO OUR TEAM

We tailor our approach to help you invest in property with clarity and confidence.